Unified case management for financial crimes

Achieve a holistic view of customer alerts

Streamline alerts, handle risk fast

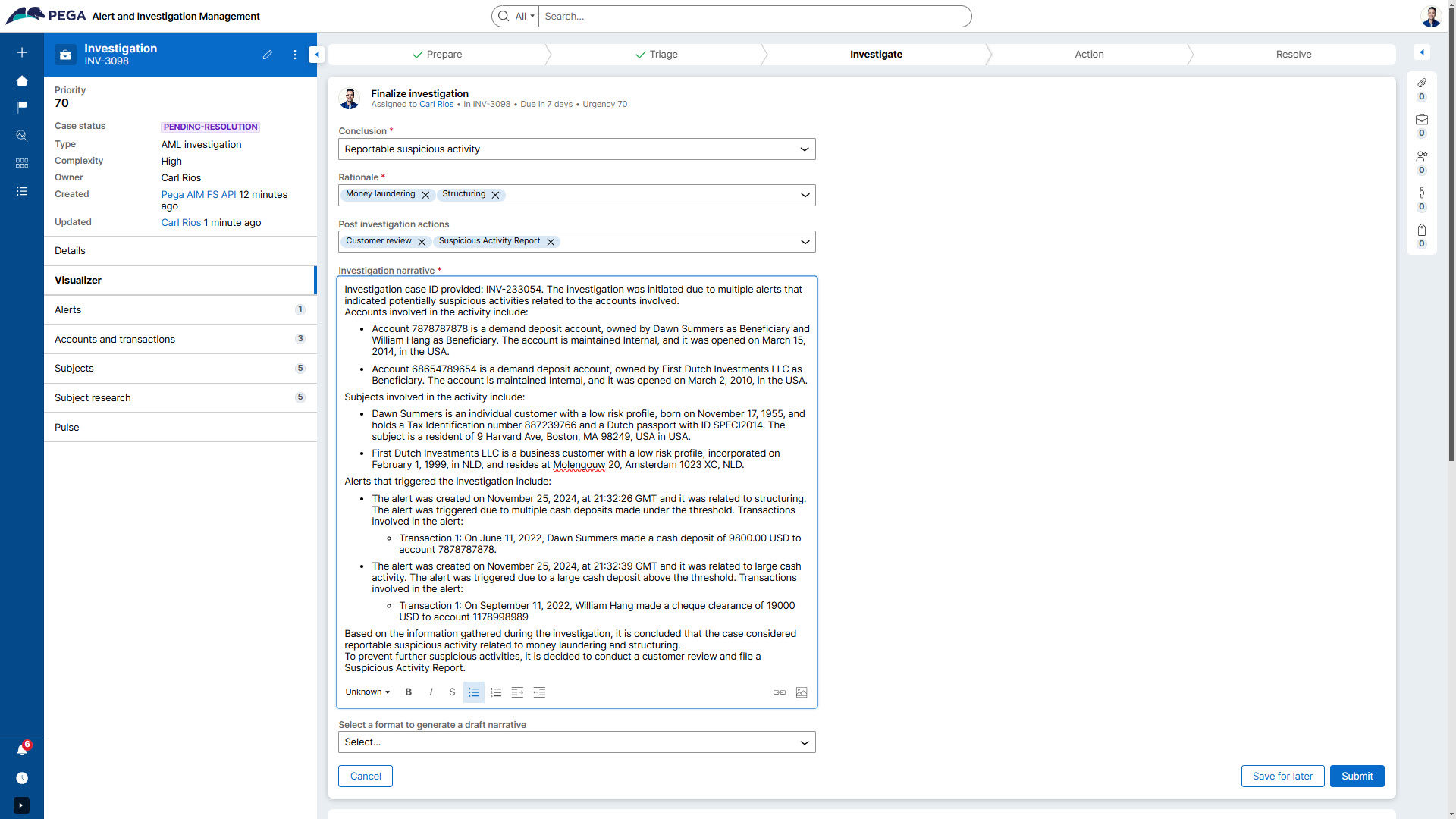

Automate SARs, stay compliant, and save costs

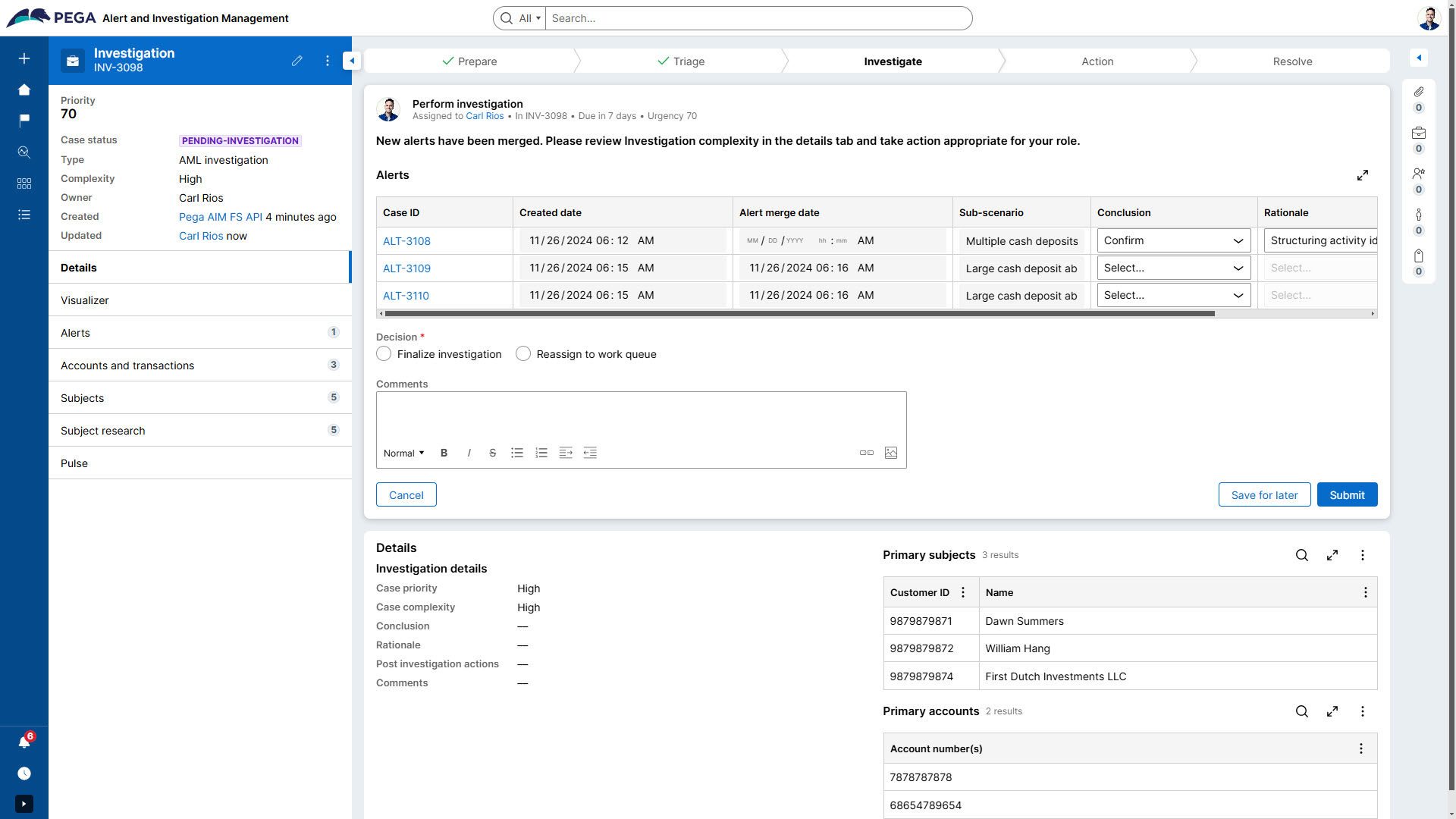

Improve outcomes with a holistic approach to case management

Consolidate alert intake from multiple detection sources, including AML, KYC/CDD, fraud, sanctions, transactions, and more, onto a single case management experience for improved investigative risk decisioning and optimized operational efficiency. Combine Pega Blueprint and Pega Alerts Investigation Management framework and in minutes get a full application design for any financial crime domain.

Transform triage with a smart approach to alerts

Classify and prioritize high volume of disparate alerts, apply intelligent skill-based routing, and streamline investigation insights, while unlocking a centralized client/subject view. Reduce false positives by ingesting predictive models from best-of-breed AI/ML providers and improve secondary alert scoring.

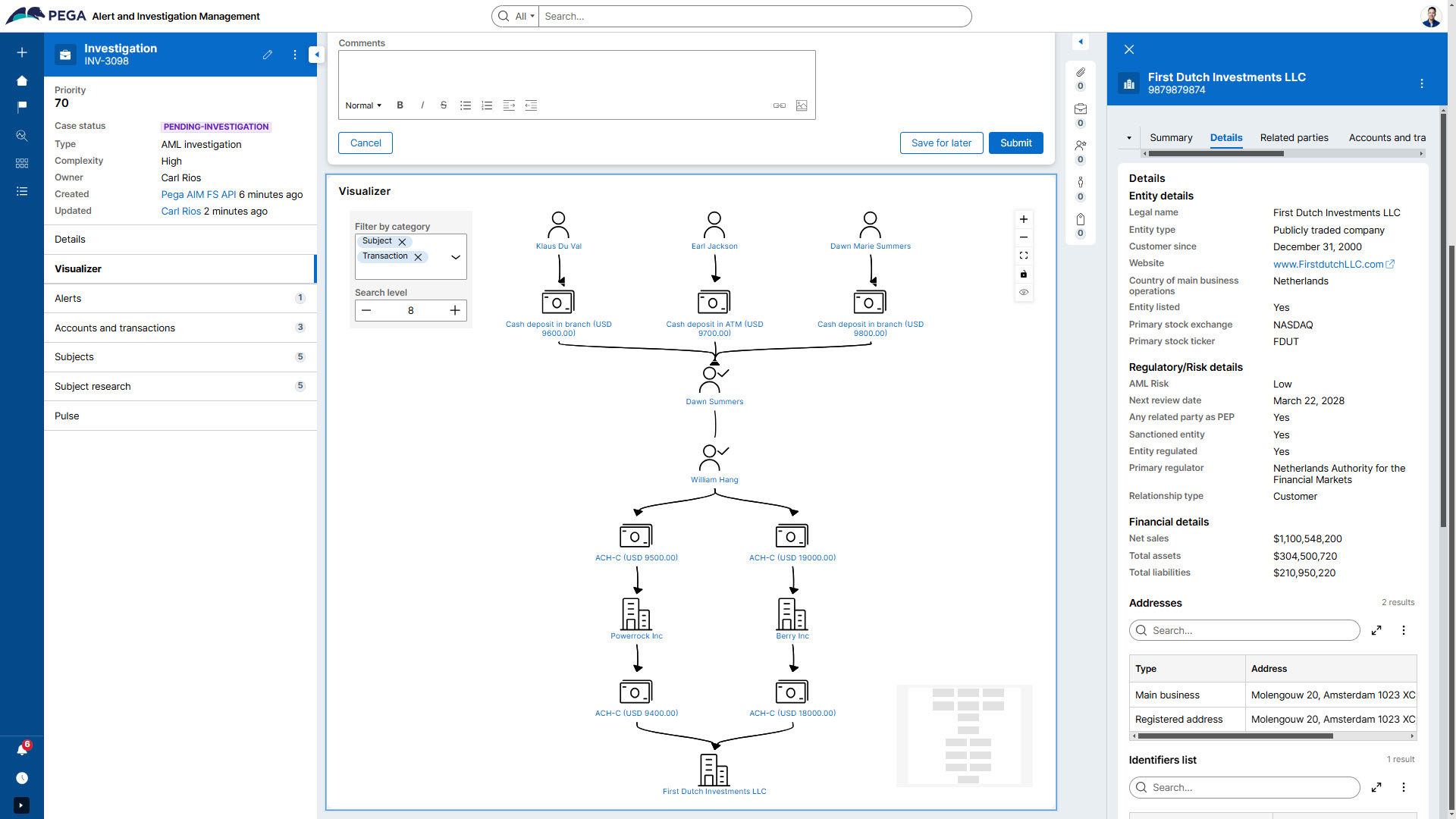

Streamline case management. data enrichment, and reporting

Bring together internal and external data to automate investigative research processes – so investigators can focus on outcomes rather than repetitive manual tasks.

See how JPMC leverages Pega with AI models to manage 9 million sanctions alerts annually, achieving a 99% straight-through processing of false sanctions alerts. The solution, which integrates with Pega’s payment investigation application, accelerates payments, enhances accuracy, controls risk, and elevates client service.