Other | 01:56

Pega Underwriting for Insurance

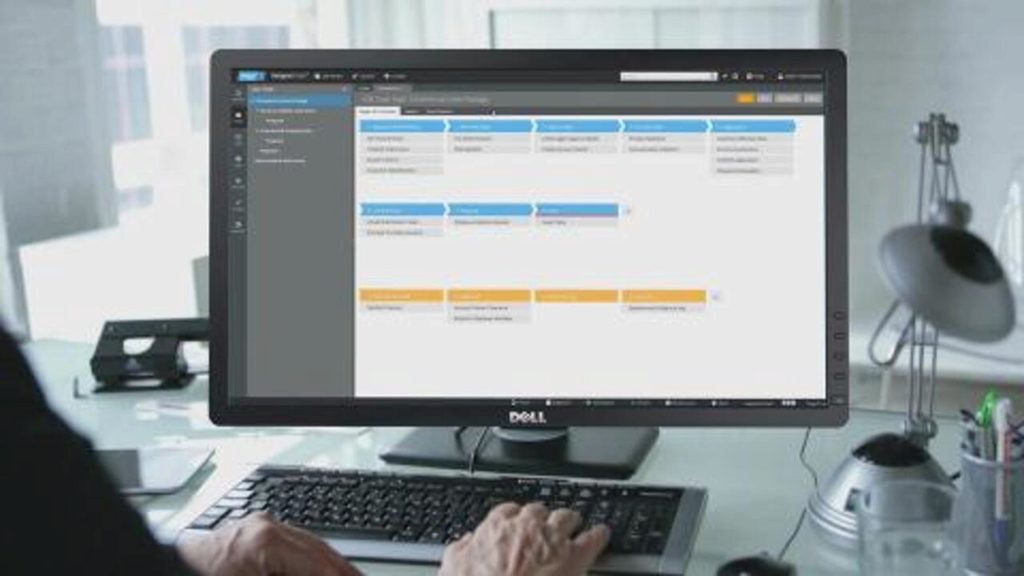

Pega’s underwriting application is designed to help carriers improve their underwriting quality and consistency, reduce operating expenses, and capitalize on new market opportunities. Its intelligent processes help carriers scale efficiently and reduce expenses by improving underwriter productivity and collaboration. Carriers can automate underwriting tasks in accordance with guidelines and bridge functional silos with robust case management, assuring complete security and auditability.

Only with Pega are you assured to make every underwriter execute like your best.

Transcript:

In order to sustain profitable growth, commercial lines carriers need an underwriting environment that can effectively respond to market changes and deliver improved operating results. Pega's underwriting solutions are designed to help carriers improve their underwriting quality and consistency, reduce operating expenses, and capitalize on new market opportunities. Pega's unified offering helps carriers eliminate gaps in their current underwriting capabilities and modernize their technology support environment on an enterprise scale.

Insurers can drive growth by using predictive and adaptive analytics to align underwriting outcomes with profitability and risk objectives. They can operationalize data and analytics directly within the underwriting process, and use analytics to power risk evaluation, risk selection, and underwriting decisions. Pega simplifies complex operating environments by accelerating the deployment of enhanced underwriting functionality across geographies, lines of business and distribution channels.

Carriers can rapidly configure, deploy, and reuse underwriting best practices with shorter delivery times, improved quality, and lower development costs. Pega's intelligent processes help carriers scale efficiently and reduce expenses by improving underwriter productivity and collaboration. Carriers can automate underwriting tasks in accordance with guidelines and bridge functional silos with robust case management, assuring complete security and audit ability. Furthermore, insurers can leverage existing technology to eliminate redundancy with fast, easy and secure integration with enterprise systems.

Only with Pega are you assured to make every underwriter execute like your best.

Related Resource

Product

App design, revolutionizedOptimize workflow design, fast, with the power of Pega GenAI Blueprint™. Set your vision and see your workflow generated on the spot.