PegaWorld | 44:24

PegaWorld iNspire 2023: Digital Automation at First Citizens Bank

First, we’ll cover First Citizens & Robolution! This is a dive into how FCB is using OCR, AI, Machine Learning and Predictive Analysis to accelerate business outcomes and auto-pilot business process.

Second, we’ll cover proactive customer service using AI-powered workflows. At FCB we believe that just having satisfied customers isn’t good enough anymore. If you really want a booming business, you have to create raving fans.

Transcript:

Scott Andrick:

Pega World. I'm going to say this every time I have to host, I'm sure, and you're going to hear it a gazillion times probably as well. I cannot tell you how psyched I am that we are actually back live and in person again. I've been coming to Pega World as a Pega employee. My name is Scott Andrick. I'm an industry principal in our banking division since 2010. So I love these events. I love the opportunity to get together, hear from our customers, talk about what they've gone through, share ideas, be able to talk afterwards, and network.

It's just amazing this opportunity that we didn't have during the Zoom era of doing all conference calls, as Joe was saying, dressed from the top-up and pajamas from the bottom down. So I also get the pleasure of working with our clients as they do these presentations and sometimes they yell at me and sometimes I yell back in terms of getting stuff done because we've got to pull this all together.

I will also say, if you've not heard of First Citizens Bank before, you should have because not only did they buy CIT Bank a few years ago to actually grow quite a bit in size from a US banking institution. I'm a CIT customer, so I always love it when I get to work with the banks where I'm actually a customer. But if you remember this little meltdown thing that we had earlier in the year with a company called SVB, First Citizens is the company that bought them in the United States. So they are at the center of a growth and acquisition strategy. We're absolutely thrilled that they're a Pega client before all this went down. We certainly hope that it's helping them absorb everything that they need to. And so if you could please put your hands together and give a warm welcome to John and Sarkar.

John Montoya:

Glad to be here. Thanks for having us. I'm actually very excited to be in person also. I'm very excited that my suit still fits after two years in hiding. So my name is John Montoya. I'm the Executive Director of Application Development and Support at First Citizens Bank. In a minute, I brought with me Sanjoy and a few other folks. Sanjoy will introduce himself in a few minutes, but here we also have representation from our operations team, from our enterprise architecture team, and from our data organization and analytics. So if we can't answer any questions, we'll put them on the spot for you.

A little bit about me. So I've been in the industry now for about 25 years or so. Wow, 25 years. I started my career as a developer, quickly joined General Electric, spent about 17 and half years there. After GE, decided to do some management consulting, so I joined PWC. And then after that, got tired of traveling so much, so I joined First Citizens Bank. Now, I'm currently responsible for two commercial lines in the bank. I have full responsibility for all of technology for the two commercial lines, all the way from our vendor portals, through our vendor onboarding, through originations, through servicing, and through end of term.

But I also have responsibility for some enterprise applications like our middleware capability that is leveraged by those two commercial lines, but also by our corporate functions. I also have support for Pega. That's why we're here today. So Pega is used heavily by our equipment finance business, is used heavily by our corporate functions and for our fraud organization across the bank. So very excited to tell you our story of our journey that we've been in the last two and a half, three years or so. So looking forward to that. So before we get started, I'll just let Sanjoy introduce himself.

Sanjoy Sarkar:

Thank you, John. Good afternoon, everybody. All right, I think we are... Good afternoon. Yeah. Hi, this is Sanjoy Sarkar. I do report to John and I do take care of digital automation. In digital automation, I do take care of a couple of technologies.

All of the technologies revolves around AI, machine learning, OCR, NLP, and Pega and robotics is basically the crux of my portfolio. As part of the technology, we have done a lot of innovations in last five years for Pega and two years in robotics. We'll go down in detail as we go through the slide. But giving a background about myself, I do have around 13, 14 years of all experience, all in AI, machine learning, Pega robotics, all across that, have worked on various banks and very proud to be part of First Citizens and driving detailed automation with John.

So before waiting further, I'll pass the ball to John to get us kick-started and we'll drill down further as we go.

John.

John Montoya:

Awesome. So the clicker is different from the one yesterday, but we'll figure it out. So First Citizens, as Scott mentioned before, we weren't known throughout the US heavily, but all of a sudden everybody recognizes our logo everywhere we go. So it's very exciting. There is a lot of change in the bank happening.

As Scott mentioned, First Citizens merged with CIT about a year and a half ago, and now Silicon Valley Bank, a tremendous amount of synergies in the acquisitions, and it's definitely a growth company. So very excited to be part of that organization. First Citizens, what it says here, we help personal business, commercial wealth, clients build financial strength that lasts and that is core to what we do in the bank.

It is headquartered in Raleigh, North Carolina, which I'll be there in the next couple of days. And this year we're actually celebrating our 125th anniversary from its inception, which is very exciting. And we build a unique legacy of strength, stability, and long-term thinking that has spanned generations. At First Citizens, we have an array of general banking services. We do have over 450 branches spread out throughout the US. We do business in 23 states, and we offer commercial banking expertise, delivering best-in-class lending, leasing, and financial services coast to coast. We also have a nationwide direct bank that if you're looking to open an online account, come in and talk to us. And we are, of course, a member of the FDIC. I'll include our URL there so you can get more details about it.

But this is key for us. Every time we do some presentations this way, we like to talk about our values, right? Because what's important to you is important to us, too. At First Citizens, we've been helping people for... God, over 125 years. We've run a lot in those 125 years, but we've never forgotten that the financial decisions are life decisions and that is key to what we do. We know that our work makes a difference for the people, businesses, communities we serve, and our associates. First Citizens focuses a lot on development of our associates and it's part of our values.

So as we like to say, money isn't everything, but so much depends on what you do with it. Our purpose; we like to say that we provide better banking for a better tomorrow. And the way we do it is through long-term thinking. That is actually very unique in being in various companies for 125 years. First Citizens really does think about the long-term in everything that they do, which is awesome to be part of that organization. We do this through service excellence. We're dedicated to help people, companies, and institutions that rely on us, acting always with integrity, transparency, and respect. And that leads to providing powerful results for our customers, for our associates, for the communities, for everywhere that we do business in is what we strive to do day in and day out.

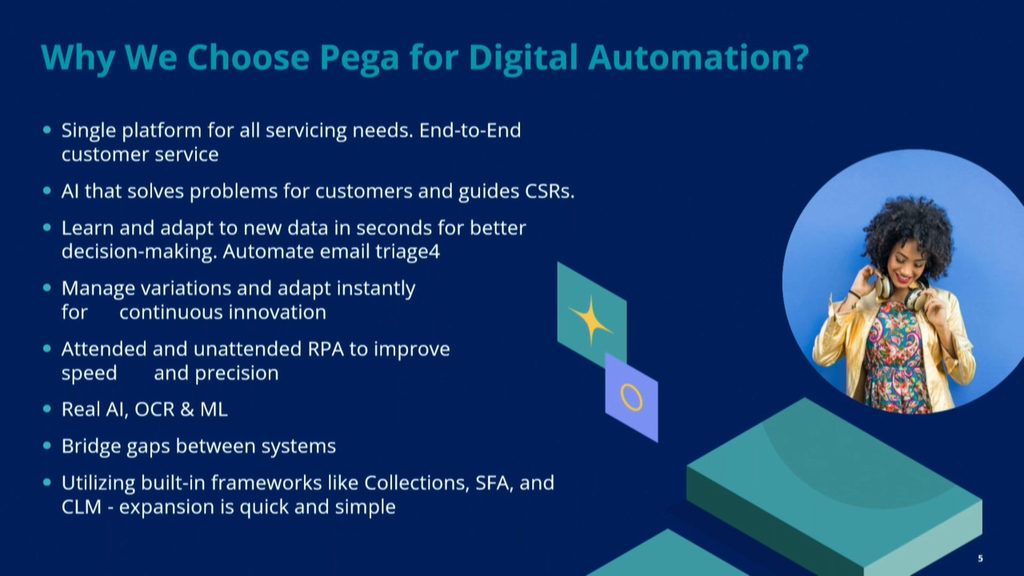

So why do we choose Pega? As you can see in the opening remarks today, it's a phenomenal tool. Lots of... I am dying to see where JNAI takes us. We'll talk about some of the AI capabilities that we've implemented at the bank and how we're using the product today and we'll kind of touch base... I wish we had more time to tell you everything that we're doing. And this man here to my left, done some tremendous things for the organization, but we'll highlight two critical use cases that have proven to be very beneficial to us.

So why do we choose Pega? To us, we like to have a single platform that services the needs end to end. We have a single platform on our front of our business. We now have a single platform on the back end of the business and we're looking to do some other things on the collections' front that will truly enable win-to-win for the customer service and operations organization. We love the AI capability; solves a lot of problems for our customers and guides our customer service reps in everything that they do. So they love to interact with the tool.

We love the way that it learns and adopts. I mean, it's amazing to see this AI capability do things on its own. It's a little scary sometimes, but our business has learned to love it and they keep asking for more and more. It also manages variations. So whenever we throw or it finds new problems or data, by itself, it'll be able to manage everything, which is kind of scary how it does it, but I've seen it firsthand.

And we also like it because we can deploy RPA solutions attended and unattended, which is key for us. I mean, that is one of the big benefits that these robots can not complain, not ask for a raise. And they work 24/7 and as Sanjoy likes to say, "A hundred percent accuracy all the time." So we love the AI, OCR, and machine learning capabilities. That is the use cases that we're going to be talking about today, how Sanjoy and the team have enabled that. And we also love it because it enables our various systems to talk to each other. So we do have a lot of systems, but we've been embarking on initiatives to digitize the organization and have them on two different platforms. And Pega, [inaudible 00:11:21] to that because it'll tie the back end in a seamless interaction for our customer service organization.

And then finally, as I mentioned, we like the frameworks that it provides. We're dying to see what '23 brings with Gen AI and how that interacts with the product. And we are looking at the collections platform, which is going to be key for us.

So First Citizens Robolution. When I was telling my boss and HR about what I was doing here today, HR goes, "Wow, I just learned a new word today," which is awesome. Robolution, I like it. I think Sanjoy came out with that one.

So firstly, there's a robolution... It's about three years now or so that we sat down and we decided to really put a practice around this capability for the bank. Again, using OCR machine learning, creative analytics, it's really helping us accelerate our outcomes for our customers both internally and externally. In late 2020 robots were introduced with a very small team. So Sanjoy's team is very lean, but they're a deep domain in the capability that we've been developing, which is awesome. And as news spreads, Sherry, she wants us to do more and more and more for the company, which is okay. We just need a little time to get it done. And again, there's a hundred percent accuracy, zero issues. I always knock on wood every time Sanjoy tells me to say that, but it's true. I mean, these things are amazing, what they do and the benefit they bring to the organization.

And then finally, Pega has really been at the center of automating all those legacy systems that we have. Because of our uniqueness in what we do in a day-to-day, there's a lot of systems back there that interact and interface with each other. So Pega is really taking and helping us simplify and digitize the organization and it's in line with our digital transformation that we're doing on the front end. So we're very excited and looking forward to what not only can we do with the tool this year and going forward, but the benefits that it'll bank for the entire organization.

Sanjoy?

Sanjoy Sarkar:

There's a lot of information. Thanks, John for bringing all those things in. Before we get started with the project or a couple of the details with respect to what we have done, couple of things that I would like to put up so that we understand why we did it. What is the need of it and how does it impact us?

So let me ask a question, let it be... Because I want this session to be a bit of interactive as well. I like questions. All right, so let me ask you, how many of you have electric cars? All right. One, two... Couple of you. How many of you have self-driving electric cars?

See? None.

All right, so... Oh, one. Oh, that's good to know.

So things are changing and Pega is built for change. That's good. So I made a recent trip to Colorado, I stayed in Austin, I traveled over there in 17 hours and I love traveling and I'm pretty much sure everybody does. So when you sit in a car and you drive, the long drive is great, the drive for... You stop for a coffee, you get a coffee, you stop for your supper, you get your supper, you stop for a lunch, you see the scenic view, and you'd talk to your friends or talk to your family, whoever is there. So it is great conversation being all together, but what do you don't like? Does somebody like steering the wheel? Putting the gas on and off, or applying brakes again and again over 17 hours?

So we agree or not down the line, self-driving cars or AI or machine learning, all these things will be... It'll be a hundred percent reality. In short, will not be driving cars down the line that everybody knows. And if we are not one step ahead of the game or in the market, then we are never going to match it up. I'll just take an example. I'm not sponsoring Tesla over here, but they did a major kind of front foot... They went all in, right? Elon went all in over Tesla and as they took that risk and it paid off, it is very tough for some other company to reach to that potential. Probably not, probably yes, but they are way ahead currently in the market.

So we started our robotics practice in 2019 or so, but all our robotics practice is not just to automate the things that any software can dance. There's lot of software in the market which can just automate your things. We didn't just automate the things, right? We have bots which perform the things and we have other bots which manages the bots. So you have a manager bot now in our system to manage the sub-bots as well. So think about bots managing the bots. We are on that level. So currently most of the companies that I have worked with have automation but doesn't have a process in and around, maybe some might have, but the process in and around to control that environment and Alan told you today the same thing. Unless you control AI, it is hard to guide the thing. And when you see the previous slide, we told clearly that we have been running with robotics for two and a half years and yes, there are zero issues still now. And that's a statement, first off.

All right, so we'll go ahead and talk about our first project. We have completed around 24 projects, complex projects running in production and I'm just going to pick two of them. One is very decent and one is the oldest one. One is the latest and the oldest. So first we'll go to the latest one. Now, during our day-to-day life, we interact with different types of documents. So each and every time, each and everything is not digitally there. So say an example, you lease something out, you buy something each and every time, you cannot get a detailed copy of the record or you cannot directly connect to the source. So there is always need of OCRing various sorts of documents, not a particular format. Let it be TIFF image, PNG, JPEG of hundreds and hundreds of different formats. So we created an, I would say, orchestration brain where you go ahead and feed any document of any type it goes and gives you the key value pair of the entire document.

Now, you might say there are various tools which we can use, but yes, but you have to use one tool for OCRing and then you have to send another to another tool to create the key value pairs. But together all in one shot with a hundred percent accuracy needs real intelligence and that's why we have this. The first project is all about that where we extract data with any sort of document. You just send that document, you get all the data back with a hundred percent accuracy in real-time. So we can use that thing for any other applications as well. And it is totally created in Pega as well as in robotics. So robotics uses a bit of ABI OCR and the PDF connector and we have integrated with some other solutions as well. And in Pega we do use AI and machine learning predictive analysis studio to create different models.

So this is a real-time example how you can take out an unstructured data and create a structured data and send data across. It is just not the OCR as we tell that. From our perspective, we go ahead and tell that there is real AI OCR technology that we have kept it. The second project is Recon. So currently we do have a process in various banks. We do have a process in our institution where the users used to go ahead and connect to various single standalone applications. Let it be a .NET application, mainframe application, Java application, external application or internal application.

And they used to connect to all this application to take out the data, massage the data, create some arti fact in around data, and feed it to some other application as well. So the entire process was connecting to 12, 13 applications getting data of quantity of 30 to 50 MB per record or per client and then massaging and feeding it in and it deals with real dollar values and what business encountered is going off with cents, going off with... The money didn't match up and there was a lot of manual labor required.

So for this, we came up with the homeroom solution using again robotics and AI to consolidate all the data across the various channels, connect to all the different application, extract and process the data and feed it to the different sources of other systems. The cost of integrating with API or the web services to all this application would've been huge, whereas we did this application within couple of months itself. And you cannot go ahead and integrate with all APIs with the external systems like you are connecting from your native cloud to some other third party. You can request them to give you access of the database or API, but if those doesn't have them it is a blocker for you.

So the second project is all-account reconciliation where we connected with various legacy systems to process the data, churn the data, and process the data and put it back into our homeroom solution.

Moving on, this is with respect to our robotics practice on high-level. Now, next piece is we are using customer service framework for our Pega implementation. And here with respect to customer service framework, we are thinking to have this framework and currently, we have created it in a way that is a one-stop solution for each and every need. We have enabled the integration of the CDH as well as collections or the SFA as it comes in to plug in directly to the module so that it kind of acts like a single one-stop solution for entire service. People don't need to go back and forth. As we go ahead and implemented this customer service, one, in the back end, what we did is we connected via all channels, let it be mail channel, let it be with respect to IVR, CIC calls and all the channels.

And what in the back end we are doing is we are taking the bulk of the work done in the back end itself. Say an example, whenever there's email sent with various forms of data and the attachment contains again various forms of data, our AI is able to understand, basically the routers are able to understand what needs to be done with that mail and then kind of create the self-service request automatically and get it completed.

Not only that, what we go ahead and do is we extract the sentiments of the customer, but we are currently keeping those inside the Pega as well for the future enhancements or the processes. As you have heard, the workforce intelligence is basically to speed up that your customer service agents are doing. So suppose how to improve the efficiency of customer service agents but how to handle or how to proactively understand what business needs change, what the client needs change. So similar concept of workforce intelligence on the business side we have enabled inside Pega CSR, which gives us an upfront notice that this is something which is being lacking and this is what business needs to do. Then we reach out to various businesses and ensure whether they really need it or not.

Moving on. Okay, so the next thing is the real pop alerts. So we would've seen in iPhone whenever there's a message or any communication comes up, it is not only the mail that comes through or the notification gets popped up, we do have various views or various businesses and for some businesses we have enabled real-time pop-ups. So if there is a notification which needs urgent attention, then basically a pop-up comes on the screen telling what is being prioritized or a list view of that so that the agent can directly work on that.

And the agents are also grouped on various channels like somebody is handling fraud, somebody is handling online application review or something of that sort. So we have enabled AI real enablement of the real notifications to the users so that they can act fast, take appropriate decisions and update the customers or inform them within the time. Now, as we have all these things built into Pega and we have RPA running in the back end, we are planning to go ahead with RDA as well. The end-to-end of any customer solutions or anything that's coming through our area have reduced drastically.

All right, so the next thing that we are thinking of doing as we do have the customer service RPA and RDA in place is basically to have the collections module and to have the CEDH in between so that we can go ahead and use the features of the CEDH and AI GenX as well to integrate on top of it to give a smooth end-to-end feature to the client to take care of each and everything into the standalone system. So that's pretty much it from my end.

John, you would like to talk about our future?

John Montoya:

Sure. Great. But before I go there, let me just go back to this slide right here. This was actually pretty cool; these two projects that Sanjoy talked about. I like to get demos of everything that we're doing and I had Sanjoy give me a demo of both of these projects when they were due.

The first one was pretty amazing because to watch this robot recognize a hundred percent OCR on multiple versions of documents, I don't know if you guys have worked with OCR in the past, I have. I implemented a huge document management implementation over a decade ago and you couldn't... Because of the way the text is oriented on a page, you never got a hundred percent accuracy. But these robots do this without any problems today, which is pretty cool and pretty amazing.

And the second one that is actually a pretty cool use case. Not only it helped the finance team with the reconciliation and the accuracy and stuff, but to watch this robot download multiple tables of data, bring it into Excel, create pivot tables, summarize, color code, and what Sanjoy would do in the demo was, "See, John, I'm not doing anything." It's pretty cool. So great job there Sanjoy and team.

Okay, so as we look into the future where we see Pega, well as I mentioned collections, it's at the heart of what we're going to be doing with it. Sherry always tells me that collections, it's a big process for us because there's a lot of data in various systems that her team needs to collect in order to effectively do collections for our company.

So we're looking at the product and especially with what I saw today with the AI capabilities that are going to be deployed, we're very excited about looking at this technology in the future and again, it's in line with everything that we're doing at the bank from a digital perspective. We love to do a lot of not only AI, but we have a lot of API B2B type of integrations we have embarked in the last four years and digitizing the bank and this is right in line where we want to go. We also are looking to expand our RPI and our RDA capabilities through Pega. We're going to have to... We're starting to staff Sanjoy's team a lot more than the lead organization we have today because there's just a lot of work for us coming down the pike. And then I think Sanjoy wanted to talk about the last two.

Sanjoy Sarkar:

Yeah. I'll talk about the last two things that we are thinking to have in our module is to provide real-time analytics to customer service agents or to the other modules that we have across the BU. For the CDHPs, that's why we want it to be there because we would like to... Currently, we do have a feature where we go ahead and try to send out or enable or send notifications, show the notifications to the user to what to do next and we do have the knowledge base included into the same suite, but we would like to go to the next step with collections with CDH where we enable the next best action as well. Because now it really makes sense to take the next step as we already have the customer service RPI and RDA well backing us up, we would like to definitely go ahead and explore the next best action opportunity where we have already implemented, but that is something which we are looking for.

The second thing is we are looking for an SFA framework to add it, to send out the email campaigns to various initiatives or any campaigns that goes out from the marketing or the business operations side, let it be on a credit card or something of that sort where we would like to track how many users clicked, how many users opened up those e-mails, how many of them replied, and so in and around that. So, this is going to be our future roadmap on our Pega practice using the CDH and Pega sales automation.

One thing that I would definitely want to add before we go ahead on the next slide is on the robotics piece. Initially, when we did the robotics piece, I'll talk an example of the last project because that is something which changed the entire thing. I'll tell you about a story here. Should not take more than a minute, but when we enabled the first robots and everybody was really bit scared, right?

Because you can Google how many Pega RPA projects or the RPA projects have been successful, they are very less, right? And when we went ahead and did it for them the first month... And we did it for just one group, right? With a set of 20 users who was using all those times manually. And then everybody looked into the group that they're utilizing that productive hours in something else. Then after three months when each and everything was running fine, the other group started approaching us and asked, "We'll go ahead and change our process according to that, can you take our work away? Can you just get it done by the bot?"

As we build the initial foundation in such a standard way that anything... As I told you about the PDF parsing, you throw anything at them, it'll do it. Similarly, when we did that reconciliation project for one BU, we knew that everybody is going to come for that and from one BU it went to 13 BUs. The amount of... And that has been running since 2019. That is the oldest project and it's been running till date without any issues. We deal with the real money or real dollars per se. So from zero trust to some trust, some trust to more, and then everybody start trusting it. The same thing that I was trying to explain with the self-driving capability. This is the future. This is going to come.

Next one is on the summary and learnings. The first one is quite self-explanatory, but the first thing that what we have seen is you have to trust the bots. You have to take a leap. Unless you take that leap, somebody else will take the leap. You will realize it after some particular point of time and by that point of time you were already delayed, you were back in the market, you had to start it from, again, scratch. So you have to take faith on the bots or the automations or any AI machine learning capabilities per se. You have to take that hard step of trusting and moving ahead and ensuring it is in a controlled manner, not an uncontrolled one, you cannot go ahead and integrate Chat GPT directly on your transaction via transaction and so forth. Definitely not that kind of thing, but a controlled manner is definitely needed.

You want to add something John?

John Montoya:

Sure. Yeah. I mean, so we learned a lot as Sanjoy mentioned. We just wrote down some of the things that we went through and you can take away and apply to your own organizations. One key one here is, fourth one down, use the MVP method and be agile. We do everything agile now. the days of waiting six months or a year to actually see capability are gone, right? Everybody wants to see what we're developing next week and the following week. And in the bank, we've adopted agile development heavily and Pega's right at the heart of that on our journey.

The next one is choose good resources and implementation partners. That is key. As you can see, there's a lot of people that customer list was... What? 500 or...

Sanjoy Sarkar:

Yeah, it was big.

John Montoya:

It was big, so there's a lot of talent and fighting amongst these organizations to actually have good talent in. Fortunately, we have one of the best ones working for us, but as you look to outsource to third parties and things like that really make you partner with individuals that have true expertise and have done this, which I met a few of them today, so that's great.

And then the one before last, make sure we have experts on staff and guarantee there's no dependency. That's why we have Sanjoy and his team. So the bank believes heavily in this practice and what we're doing. So we started with one, now we're a team of four and we're growing. So we are looking to take this capability and expand.

Sanjoy Sarkar:

We're not considering consent, right?

John Montoya:

Right. This is FTEs. We are looking to implement full FTEs that have the domain so that we can then build a practice around it. And then the last one, select the appropriate team size.

I'm a big believer that the days of meeting 20, 30 people together to actually accomplish something are gone. If you're in a meeting with more than 10 people, get out. Keep it simple, keep it small, and keep it diverse. I mean, that is probably one of the things that I'll leave you with. Make sure that your teams are very diverse because you want to see different points of views, but smaller agile teams can get things done a lot faster.

Sanjoy Sarkar:

Yeah.

John Montoya:

Anything else?

Sanjoy Sarkar:

One thing... Go ahead, John, you have something?

John Montoya:

No.

Sanjoy Sarkar:

Okay. One thing definitely I would add this up is certainly brought... So the bot of trust. So when we do some project and deliver it to business, we do it in a way that the business kind of feels it's really helping them. So I'll just take one of the examples. We did some automations in and around for business, for GL account pieces, and when we went live... We connect to various external systems as well and we don't have a control if they changed the UI and we just went live. So we were kind of learning in 2019 and we got information that was... The process have changed a bit, so we have to change our code accordingly. And it was three months that the bot went live and the Pega pieces, the framework was already there.

I reached out to the business and I told, "Hey, we need two weeks to get everything done and we'll be thinking about the futuristic approach and ensure we are bulletproof. But can you do this process for two weeks manually? You have been doing it from last five years." And they were, "We'll wait." So they were like, "Exactly, don't worries, enjoy. We are going to wait. We don't want to do this process manually, right? The reason behind it is once you, again, the process, when the process is optimized, everything repetitive and it is accurate. That is what matters, then you are going to get addicted to it and you are going to utilize that time somewhere else usefully, same like driving a Tesla, put it on a self-drive more, let it run 17 hours while I do some other stuff. I don't want to hold the wheel and honk or take care of the gears and everything of that sort.

John Montoya:

So look, I think we've run out of time, so I just want to say thank you and leave you with our first bullet there. Put your faith in robots and let them reach their greatest potential. That is one of the greatest takeaways we can leave you with. Thank you so much and look forward to any questions you may have.

Sanjoy Sarkar:

Thank you.

Scott Andrick:

Thank you. Excellent. We have just a couple of minutes. If you want to ask a question, we got about literally four minutes left. There is a microphone in each of the aisles if you'd like to come up and ask them a question. But while you guys are coming together, I'll throw out the obvious question because this one always comes up.

What was the key challenge you faced and how did you overcome it when you did the implementation?

John Montoya:

Well, there were many challenges. The first one probably is there is a fearful factor out there. People are afraid of this, believe it or not. They're thinking that Sanjoy and John are coming in and there goes my job. That's not what we're doing. We're here to make your lives easier. Take all that manual work out of the way and let your brain do the things that actually can grow the company better.

Sanjoy Sarkar:

Exactly.

John Montoya:

So that is something that it took us a while to get the organization to kind of believe in us, but they're now fully there. They're fully adopted, they see the benefits. We were joking actually before that I bet you if we took some of these robots out, people would be freaking out. But that is probably the biggest one that we had to overcome.

Sanjoy Sarkar:

No, I think John covered everything, but one thing definitely I will say is you need to have expertise in house, okay? So you cannot build a house just dependent on totally on somebody else. Very important. You need to have expertise as well as experienced partners with you to get everything done. But unless you have expertise in house, then you are totally dependent and you don't want to be a hundred percent dependent. You want an extreme powerful partner and you want expertise in house that is very key for a perfect execution of any project.

Scott Andrick:

Okay, awesome. Seeing nobody... Oh, we got somebody coming up to the mic. I almost can't see because I'm literally blinded by the lights up here. Go ahead here on the side. Completely blinded here.

Speaker 4:

Hi, myself [inaudible 00:41:30]. I'm from an insurance firm. Basically I have a question on specifically to the OCR. We have a lot of use cases on scanning the document and then looking for some contents in the document. So if you... Just wanted to understand what OCR solution has basically been picked up, because if you go to Pega, talk to anyone from the Pegasystems, multiple answers would be there.

Say there is an OCR integration integrated with external party who is a hyper science. Then OCR in marketplace, OCR integrated with RPA definitely, or a hundred percent... What do you call, accuracy definitely is promising. So wanted to understand which one you have used in your organization for your use case.

Sanjoy Sarkar:

Absolutely, I'll take that up.

Initially, there are two ways to... I'll answer this question. You can handle this in two ways. First is if you want to go totally with Pega, what we have done is we have totally worked with Pega, but we didn't go with having an OCR engine, say Abbey OCR full version. And then you can stack the data and send it over to IBM Watson basically to do the key paired values and send you over. You can use other software too, but in this scenario what you are going to run out is dependencies.

Every product is not a hundred percent and you cannot control the product dependencies on the Watson size or say an example on the Abbey OCR size. But Pega is a powerful tool. It gives you a limited version of Abbey OCR, which you can use with PDF Connector. And on Pega Prediction Studio you can define different models.

So once you go ahead and pass the data to the models, the model does amazing job, but you have to really structure the models, which is your master models and sub-models. So your OCR does half of the work and then other works is being done by the models. And you can write the Python and router scripts inside that and put it over there to get the entire execution done within Pega and robotics within the same framework because then you can play a number of things. It is all yours. You have control over each and everything.

I wouldn't definitely... I'm not, again, advocating that you should not go with the external third-party vendors or the software like IBM and all, but it is always to have the things right. We are going for unified solution. You keep the things together so that you have more control over it and we found success in that way. Only OCR will never ever give you a hundred percent of data. You have to use Prediction Studio as well as the AI and the machine learning, a small amount of Python code to get a hundred percent accuracy, which we told that we got. Thank you.

Related Resource

Product

App design, revolutionizedOptimize workflow design, fast, with the power of Pega GenAI Blueprint™. Set your vision and see your workflow generated on the spot.