Pega Smart Dispute Agentic Automation for Issuers

Streamline and automate disputes and fraud claims

For over two decades, leading financial institutions globally have relied on Pega for effective dispute management. The next generation of Smart Dispute Agentic Automation combines fully integrated AI and workflow automation to unify dispute operations and manage the full dispute lifecycle with dramatically improved straight-through-processing (STP), efficiency, compliance, and satisfaction.

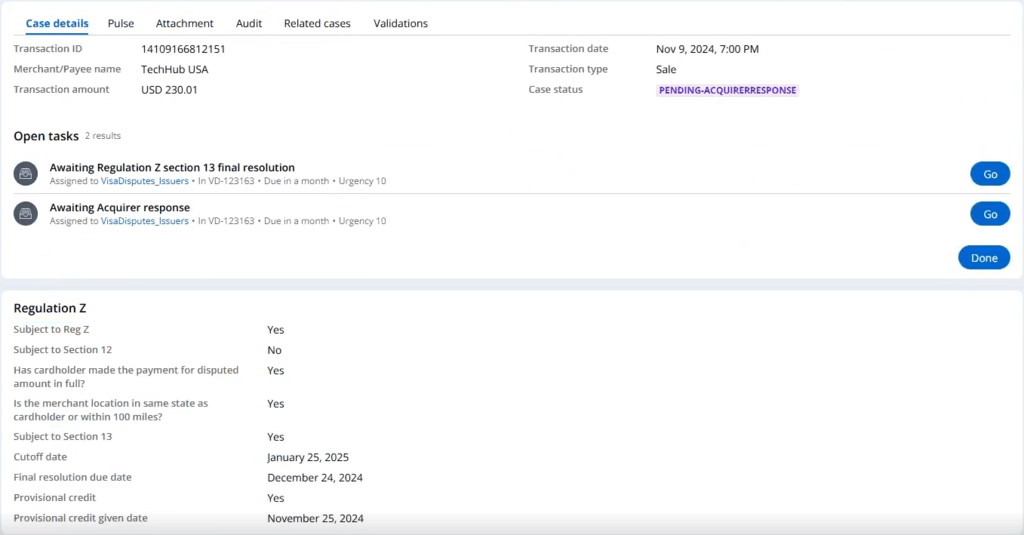

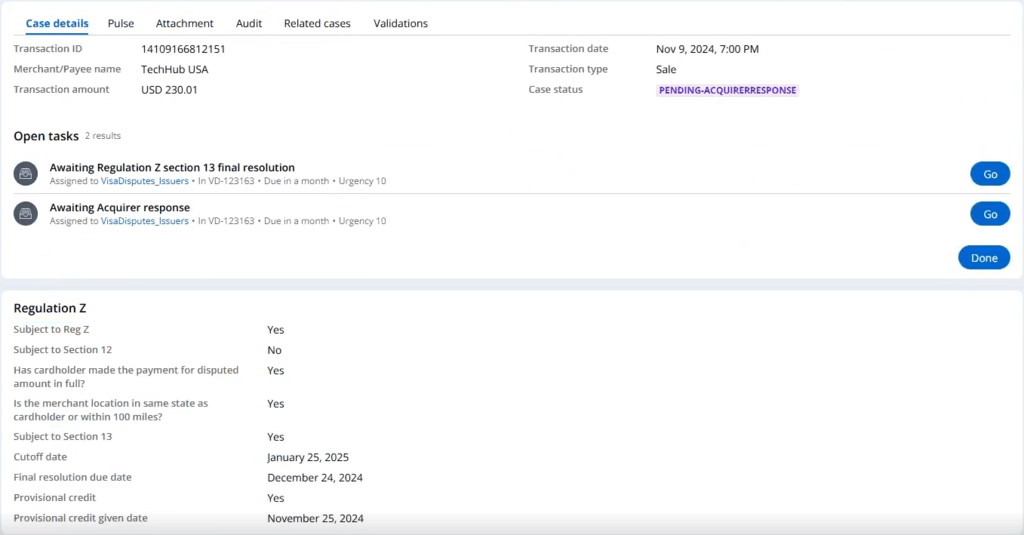

Adhere to network rules and government regulations

Smart Dispute Agentic Automation systemically supports network dispute rules for AMEX, Mastercard, and Visa - including integrations to VROL/MCOM and ethoca/Verifi – with updates twice a year as well as consumer protection regulation SLAs for Reg E & Z, C-86, and Section 75.

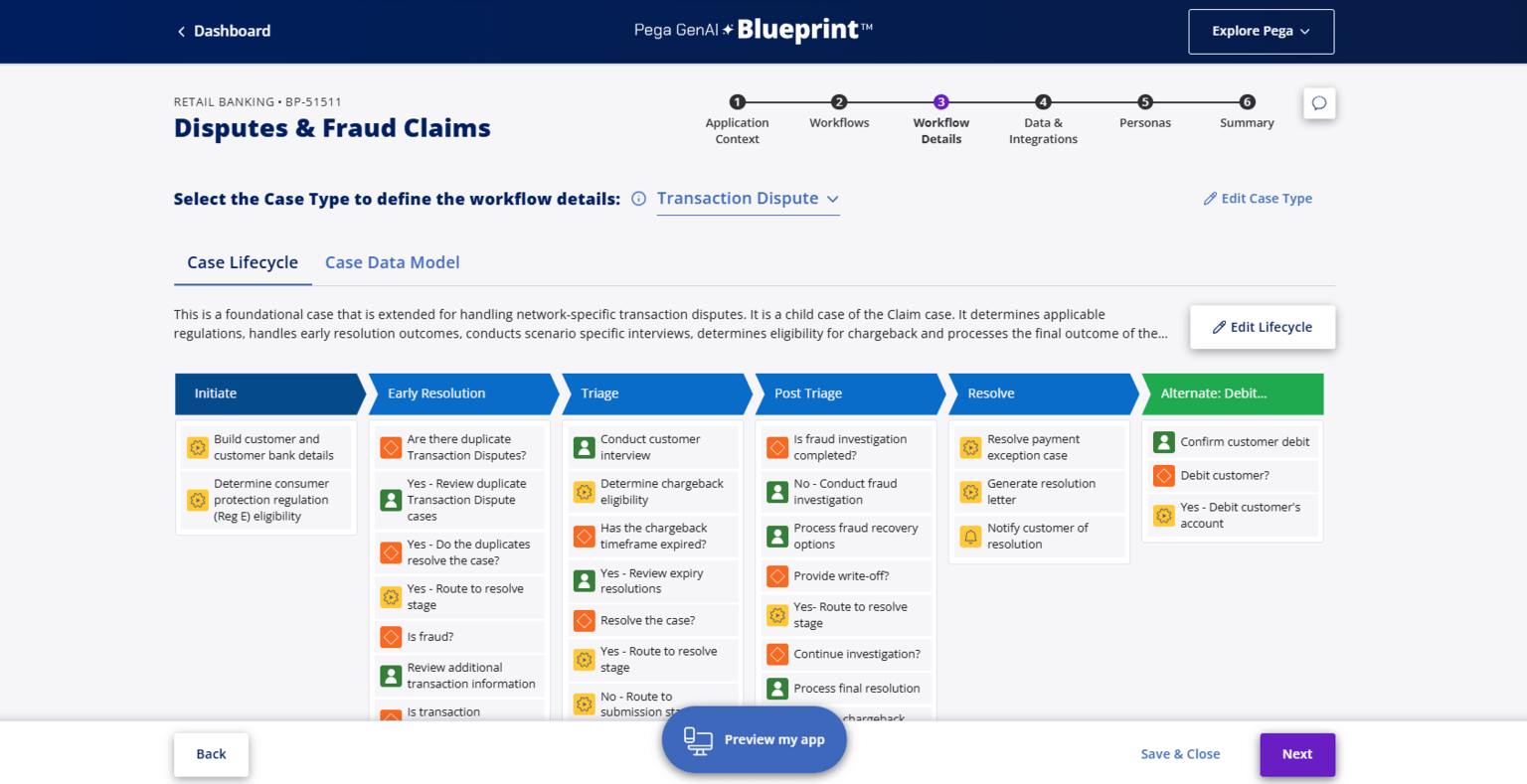

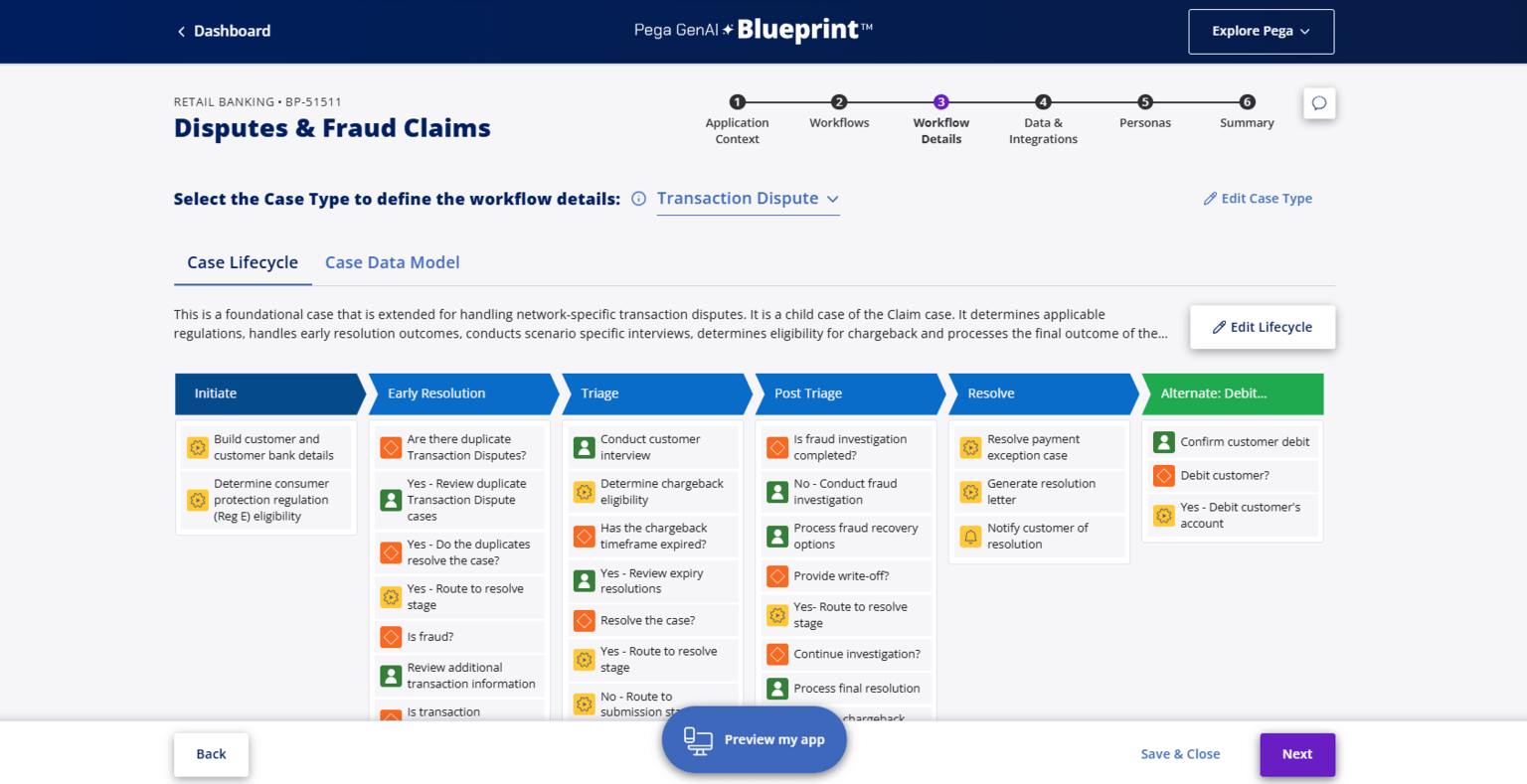

Build for today, ready for tomorrow

Experience a cradle-to-grave dispute solution powered by Pega’s industry-leading enterprise AI decisioning and workflow automation platform. Adapt your payment dispute operations for any new and emerging payment types in just weeks or even days using Pega GenAI Blueprint™.

Engage customers in their preferred channel

Pega's modern APIs allow interactions to adapt seamlessly to any device for smooth self-service options while seamless integration with Pega Customer Service ensures interactions can switch channels without losing context. See how Nationwide managed their dispute volume surge while improving resolution time by 86%.

Deliver first-time resolution excellence

Guided processing and GenAI delivered knowledge management helps both employees and customers in digital self-service channels capture all essential information up front for improved STP and reduced callbacks. Where manual reviews are needed, intelligent workflows eliminate repetitive tasks and improve quality.